73

ON FARM LEVEL

Value chain

Imports / Chicken / Grain and oilseeds

Importance of the poultry industry

within the grain and oilseeds value chain

T

he poultry industry is currently under enormous pressure.

As explained in various reports, this is due to not receiv-

ing sufficient anti-dumping support. In December last year,

the Department of Trade and Industry announced a 13,9%

safeguard.

According to various role-players within the poultry industry this

is not sufficient in order to ensure the sustainability of the poultry

industry. The lack of support resulted in producers decreasing pro-

duction and even ceasing chicken production, due to the fact that it

is just not possible to compete with the imports.

The local industry can compete on a whole bird basis, but not in

terms of cut imports. However, this is also not a very favourable sce-

nario for the grain industry, mainly because the poultry industry is

a very important market within the grain and oilseeds value chain.

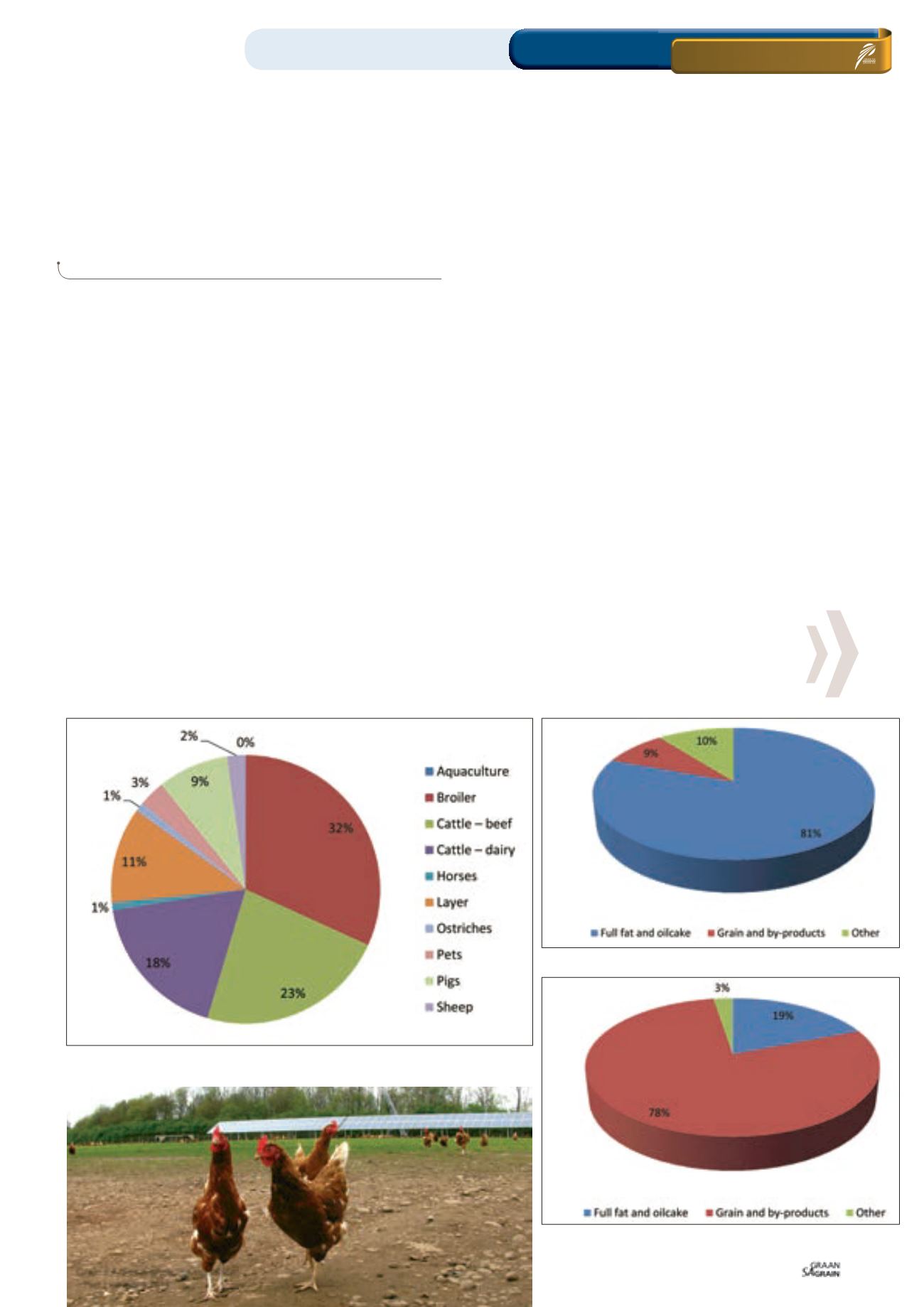

In terms of feed produced from grain and oilseeds, the broiler and

layer industry consumes 32% and 11% respectively. This is almost

half of the market.

Graph 1

explains the importance of the poultry

market within the grain and oilseeds value chain.

As much as 4,6 million tons of feed are consumed by the local

broiler and layer industries within a year. The broiler industry’s

feed composition will consist of 81% oilcake and full fat products

and 9% grain and grain by-products. This is a total of 90% grain and

oilseeds-related (

Graph 2

).

This would be 78% grain and grain by-products, 19% full fat and

oilcake and 3% other raw materials (

Graph 3

) is for layers. For lay-

ers, 97% of the feed composition is linked to the grain and oilseeds

industry.

It is clear from the above-mentioned that there is a close link be-

tween the poultry industry and the grain and oilseeds industry.

Therefore, if the poultry industry has a decrease in local production,

this will also have an effect on the demand for grain and oilseeds.

The effect that additional imports of chicken meat will have on the

volume of raw materials required for animal feeds in South Africa,

was simulated by De Jager (2016).

Additional imports of 65 000 tons of chicken meat per year not sub-

jected to any import tariff, would cause an average annual decrease

of 1,41% in demand for total raw material, while the yellow maize

demand is projected to decrease by 1,43% annually.

The total protein consumption is projected to decrease 1,89%

annually if the additional chicken imports occur and less local pro-

duction is needed.

DIRK STRYDOM,

manager: Grain Economy and Marketing, Grain SA

Graph 1: Consumption of grain and oilseeds feed per species.

Source: APR model

Graph 2: Raw material composition of broiler diets.

Graph 3: Raw material composition of layer diets.

Grain SA/Sasol photo competition

– Piet Lombard 2014