Augustus 2018

94

Wheat turnaround strategy:

Value for producers?

I

n the last four years Grain SA worked

hard in bringing changes to the wheat

industry in order to make it more sus

tainable for local wheat producers. In

April, an article was published in

SA Graan/

Grain

explaining the progress as well

as the challenges with the current turna-

round strategy.

It is no illusion that wheat producers are

under tremendous financial pressure and

that the sustainability of wheat production

is diminishing. The droughts of the past few

years fast-tracked and amplified this dimin-

ishing sustainability. Several of the produc-

ers and industry role-players are under the

impression that these changes have not had

a substantial impact on the local producers’

financial position.

Various economists, myself included, were

under the impression that if the Western

Cape region produced below the demand

of ± 600 000 tons the problem of an over-

supply (regional export status) would be

solved or at least be reflected in pricing

and premiums offered to producers. Dur-

ing the past season though, the drought

facilitated this process and less than

600 000 tons were produced, with very

little effect on prices.

We were wrong, mainly because we un-

derestimated the effect of the imbalance of

market power and the impact of imports.

This emphasised the importance of the

turnaround strategy; therefore Grain SA

asked the Bureau for Food and Agricultural

Policy (BFAP) to investigate the possible

impact of the turnaround strategy and the

benefits it might hold.

One of the greatest concerns within the

wheat industry is that the local producers

produce some of the best quality wheat

in the world, but they don’t receive prices

suitable for this superior quality. The prices

received are more suitable for imported

Russian wheat (comparative level of protein,

but of lower quality) and not that of hard

red winter wheat (comparative quantity

and more or less the same quality of wheat

produced locally).

How do you address this problem? You

change the grading regulation to accom-

modate quantity in accordance with that

of imports. This is only quantity in terms of

protein content, which can be managed by

means of production practices. Millers and

bakers are more concerned about quality in

terms of intrinsic values; in layman’s terms

the quality of the protein.

Secondly you need to increase the wheat

yield. Protein quality (intrinsic values) and

yield are negatively correlated. Therefore,

the higher the quality, the lower the yields.

This means that we need to breed new cul-

tivars to increase yield. This, however, is

a timeous process.

On farm level

Wheat / Quality / Yield improvement

Sustainability

Dr Dirk Strydom,

manager: Grain Economy and Marketing, Grain SA

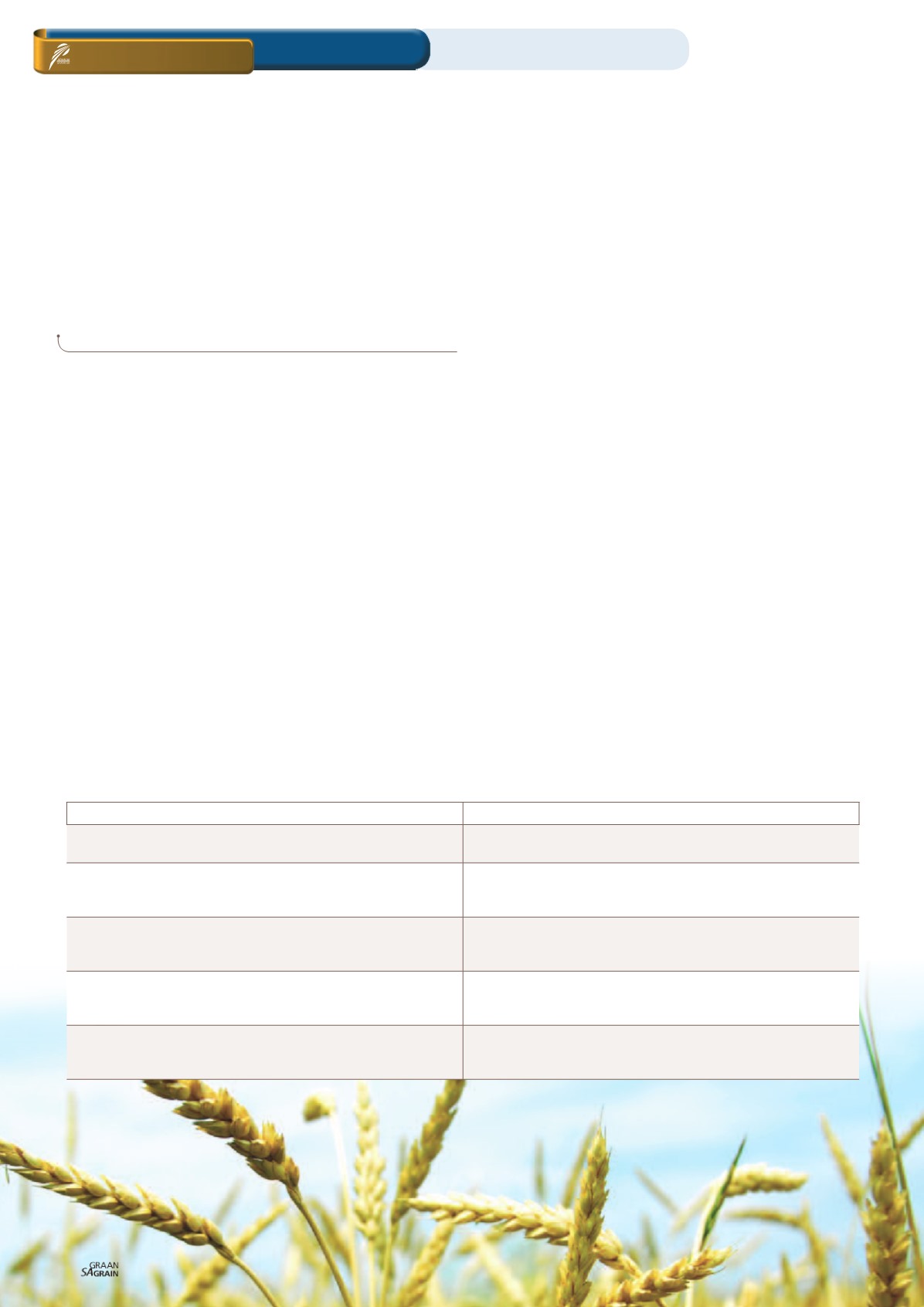

SCENARIO

ASSUMPTIONS

Baseline

Existing production approach – produce higher protein content

with the objective to produce B1 quality wheat (12% protein)

Scenario 1: Produce standard B2 wheat

– 20 kg less nitrogen requirement

Change production approach to produce standard B2 quality wheat

(less 1% protein to 11% average) – scenario assumes that between

10 kg - 20 kg less nitrogen is applied per hectare

Scenario 2: Less protein – higher yield of 5%

Standard B2 quality approach (SCN1) – less 20 kg of nitrogen per

hectare – scenario further assumes that new wheat seed varieties

will lead to an increase in yield of 5%

Scenario 3: Less protein – higher yield of 10%

Standard B2 quality approach (SCN1) – less 20 kg of nitrogen per

hectare – scenario further assumes that new wheat seed varieties

will lead to an increase in yield of 10%

Scenario 4: Less protein – higher yield of 20%

Standard B2 quality approach (SCN1) – less 20 kg of nitrogen per

hectare – scenario further assumes that new wheat seed varieties

will lead to an increase in yield of 20%

Table 1: Scenario of a change in quality and yield improvement.