ႆႋ

CHAPTER 1

crop, with Mpumalanga the second biggest producer (26%), followed by Limpopo

(10%), North West (7%) and Gauteng (2%).

In the period from 2000/2001 until 2014/2015 the total South African sorghum crop

varied between 96 000 tons (in 2005/2006) and 373 000 tons (in 2003/2004), with

an average of 203 360 tons/year.

Graph 18 depicts the yield/hectare of sorghum planted from 1990/1991 until

2015/2016.

Although South Africa is a net exporter of sorghum, trade in this commodity with

other African countries remained relatively low compared to other grains, probably

because some of the other African countries produce even more sorghum than

South Africa. However, exports in 2004 and 2005 were mainly to African countries,

particularly Botswana. Because of quality requirements in Botswana it is vital for the

product to comply with certain minimum standards.

Marketing and prices

From the 1944/1945 to the 1948/1949 season sorghum marketing was handled

by the Maize Board, but from 1949 to 1957 there was no formal control over this

marketing. From the 1957/1958 season onwards sorghum was again marketed by

the Maize Board as part of the Summer Grain Scheme until the Sorghum Board

was established on 31 January 1986. This board then took control of sorghum

marketing until the Marketing of Agricultural Products Act of 1996 came into

effect on 1 January 1997. After that sorghum, like the other grains in South Africa,

was traded without restriction on the free market.

Sorghum prices fluctuate considerably. When local sorghum production exceeds

the domestic consumption needs for food and beverages, the sorghum price is de-

termined by the lowest price of competing grain (yellow maize). In years in which

the domestic demand for sorghum is greater than the local production, the price

depends on the import parity and the premium paid for malt quality.

During 2005 and at the beginning of 2006 sorghum producers experienced enor-

mous cost-price pressure. Producer prices of sorghum dropped drastically, main-

ly because of overproduction and a stronger currency rate, while input costs of

imported inputs like fuel, chemicals and fertiliser increased rapidly. This raised

doubts about the prospects of cultivating sorghum sustainably and profitably in

South Africa and led to producers being forced to scale down plantings.

Levies

Statutory levies on sorghum that are collected in terms of the Marketing of Agricul-

tural Products Act of 1996 are revised from time to time and the income from these

is employed for research purposes by the Sorghum Trust.

The current levies on sorghum apply until 28 February 2018.

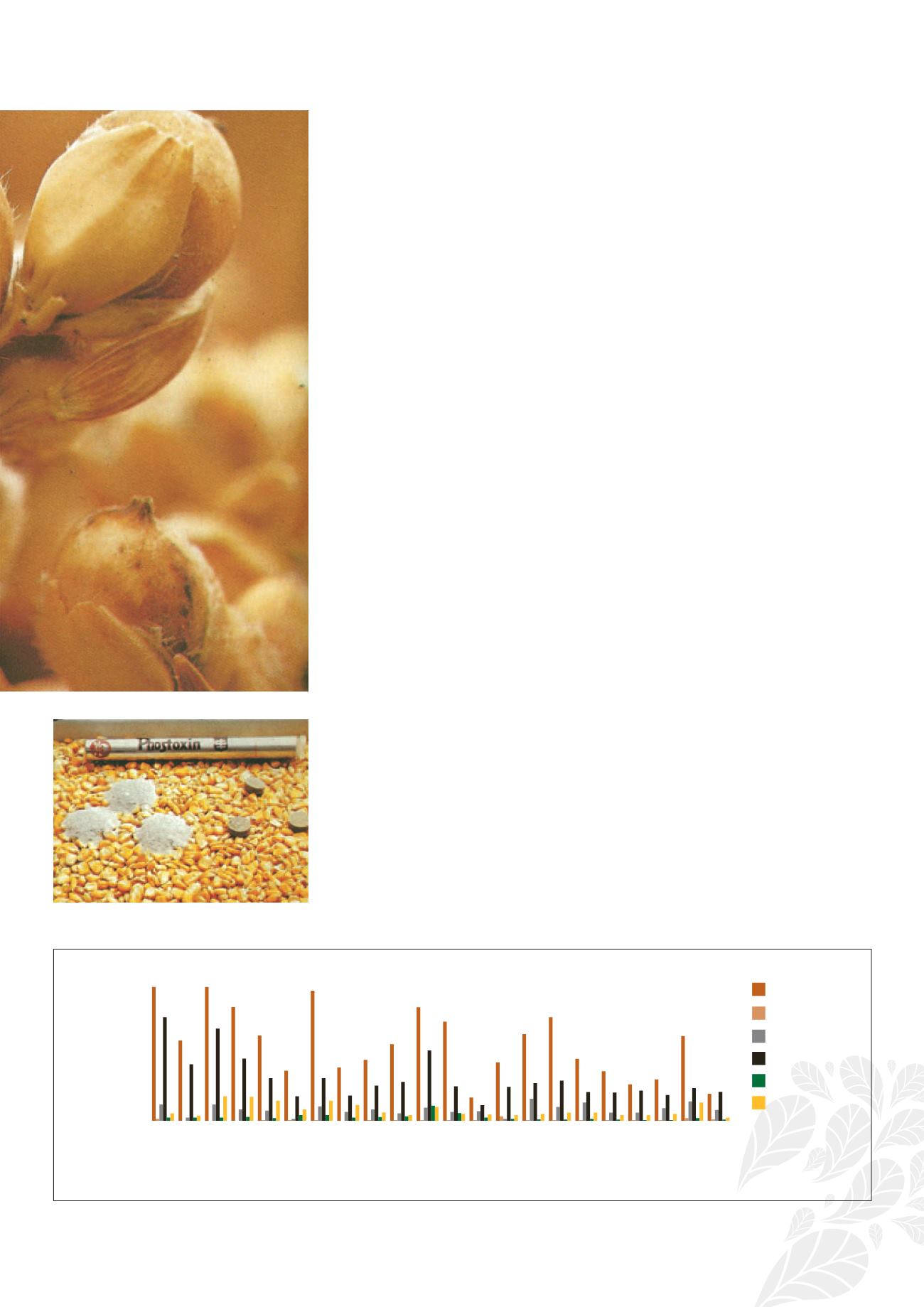

The fumigation of grain against insects.

250,0

200,0

150,0

100,0

50,0

0,0

Tons (thousand)

1993/1994

1994/1995

1995/1996

1996/1997

1997/1998

1998/1999

1999/2000

2000/2001

2001/2002

2002/2003

2003/2004

2004/2005

2005/2006

2006/2007

2007/2008

2008/2009

2009/2010

2010/2011

2011/2012

2012/2013

2013/2014

2014/2015

Free State

Limpopo

Gauteng

KwaZulu-Natal

Mpumalanga

North West

Graph 17: Sorghum production per province