June 2024

| LERATO RAMAFOKO, AGRICULTURAL ECONOMIST INTERN, GRAIN SA |  |

As South Africa navigates through its current grain marketing season, prolonged droughts and recent unfavourable rain conditions have posed significant challenges for local farmers, which is impacting production. However, these late and inconsistent rain patterns have supported prices in the local market.

The drought’s impact extends beyond South Africa, affecting neighbouring countries such as Zambia, Malawi and Zimbabwe, which have declared states of disaster. These countries may increasingly depend on South African exports to meet their demand.

South Africa’s Crop Estimates Committee (CEC), whose main function is to provide regular and accurate estimates of the crop production levels in South Africa, has reduced its earlier forecasts for maize and other summer crops due to recent summer heatwaves from the El Niño.

According to the CEC report, maize production for 2024 is projected to be 13,255 million tons. This forecast represents a decrease of about 7,69% from the previous estimate of 14,359 million tons, with an expected yield of 5,03 t/ha. Compared to the 2023 crop, the estimated maize production for 2024 is 19,32% lower, amounting to 3,174 million tons less.

The three primary maize-producing regions – the Free State, Mpumalanga and North West – are anticipated to contribute 79% of the total maize crop for 2024. For the 2023/2024 marketing season, exports are projected to include 548 000 tons of processed maize products and 3 210 000 tons of total whole maize (NAMC, Supply and Demand Estimates, March 2024).

Possible drought-induced changes in the grain may include:

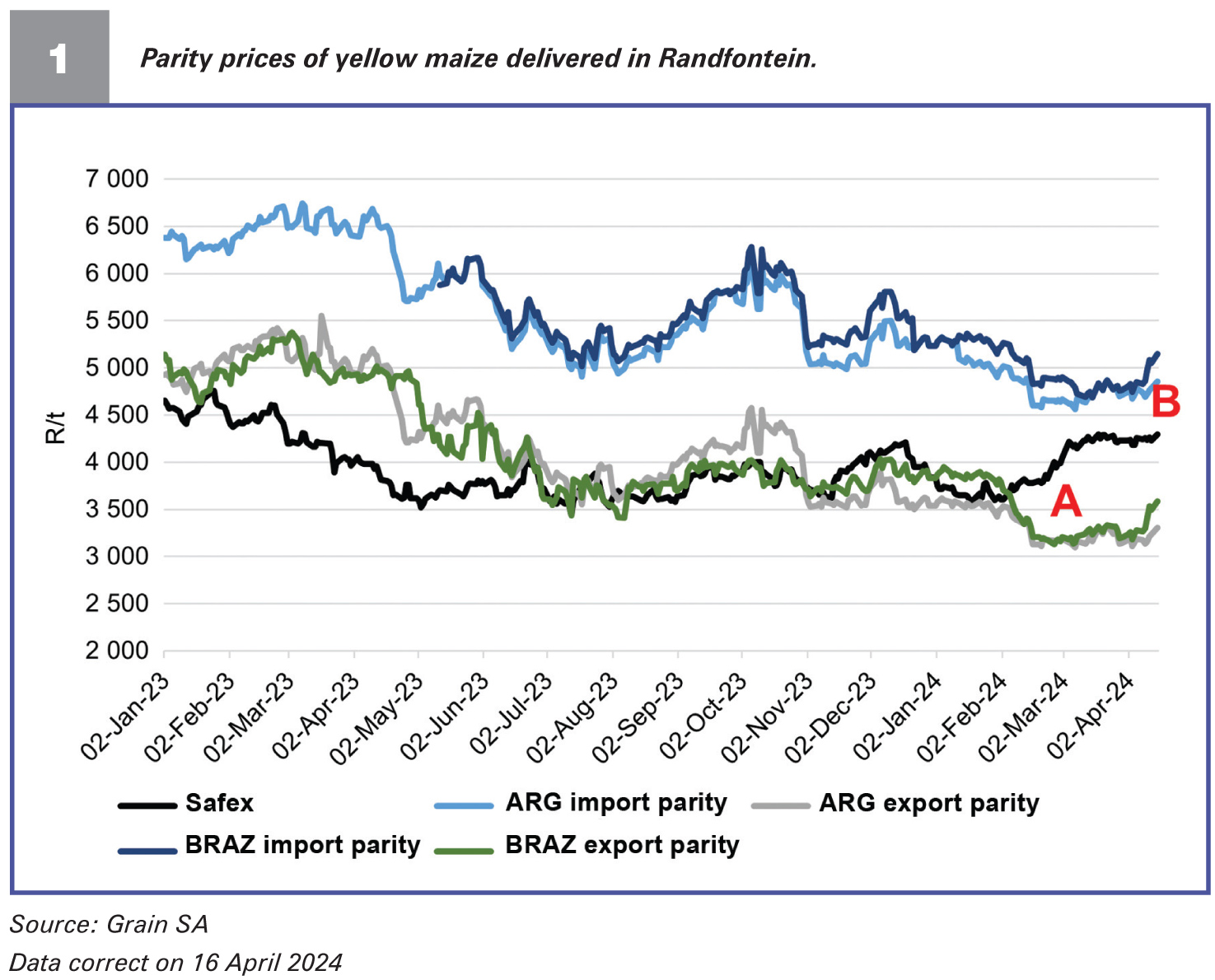

Graph 1 shows the parity price movements of yellow maize delivered in Randfontein for the past year. Furthermore, the graph shows that for the 2023/2024 marketing year, prices are moving towards import parity (Brazilian and Argentinian import parity prices). The graph is further explained below:

IN CONCLUSION

Farmers are navigating through a complex landscape marked by intense and unpredictable climate variations, reduced crop forecasts and fluctuating market prices. These challenges highlight the importance of resilience, adaptability and strategic planning for developing farmers as they strive to maintain their livelihoods and contribute to food security.

For developing farmers, navigating these shifting market dynamics requires flexibility, resilience and strategic planning. This can be done through adapting production practices, diversifying crops, exploring niche markets, coming up with and implementing rigorous marketing plans or investing in value-added products to respond effectively to changes in the demand, pricing and consumer behaviour following a drought. Through innovation and determination, developing farmers can turn these challenges into opportunities for growth and sustainability.

Publication: June 2024

Section: Pula/Imvula