Mei 2014

22

Howwell doSouthAfrican

grainproducers plan their personal finances?

D

uring 2013, Old Mutual commis-

sioned Marketing Surveys & Sta-

tistical Analysis (MSSA) to do

research that reveals interesting

facts about commercial producers and also

specific factsabout thewaygrainproducers

(grain producers in this article refer to pro-

ducers who are producing summer crops

as their primary farming activity) approach

personal financial planning. A fewof the as-

pects arehighlighted in the article.

The Old Mutual MSSA research revealed

that the annual turnover of grain producers

outweighs the average annual turnover of

all commercial producers. In thecategoryof

R5millionandhigher inannual turnover, the

percentage for all commercial producers is

10%, compared to 75% for grainproducers.

Accredited financial advisers may not un-

derstand much about the operational chal-

lenges tomanage a grain farm successfully,

but they do understand the risky nature of

farming and how important it is to have a fi-

nancial partner throughevery lifestage. Per-

sonal financial planningwill create certainty

inuncertain timesandensure that astrategy

is inplace toprotect your grain farm against

uncontrollable events.

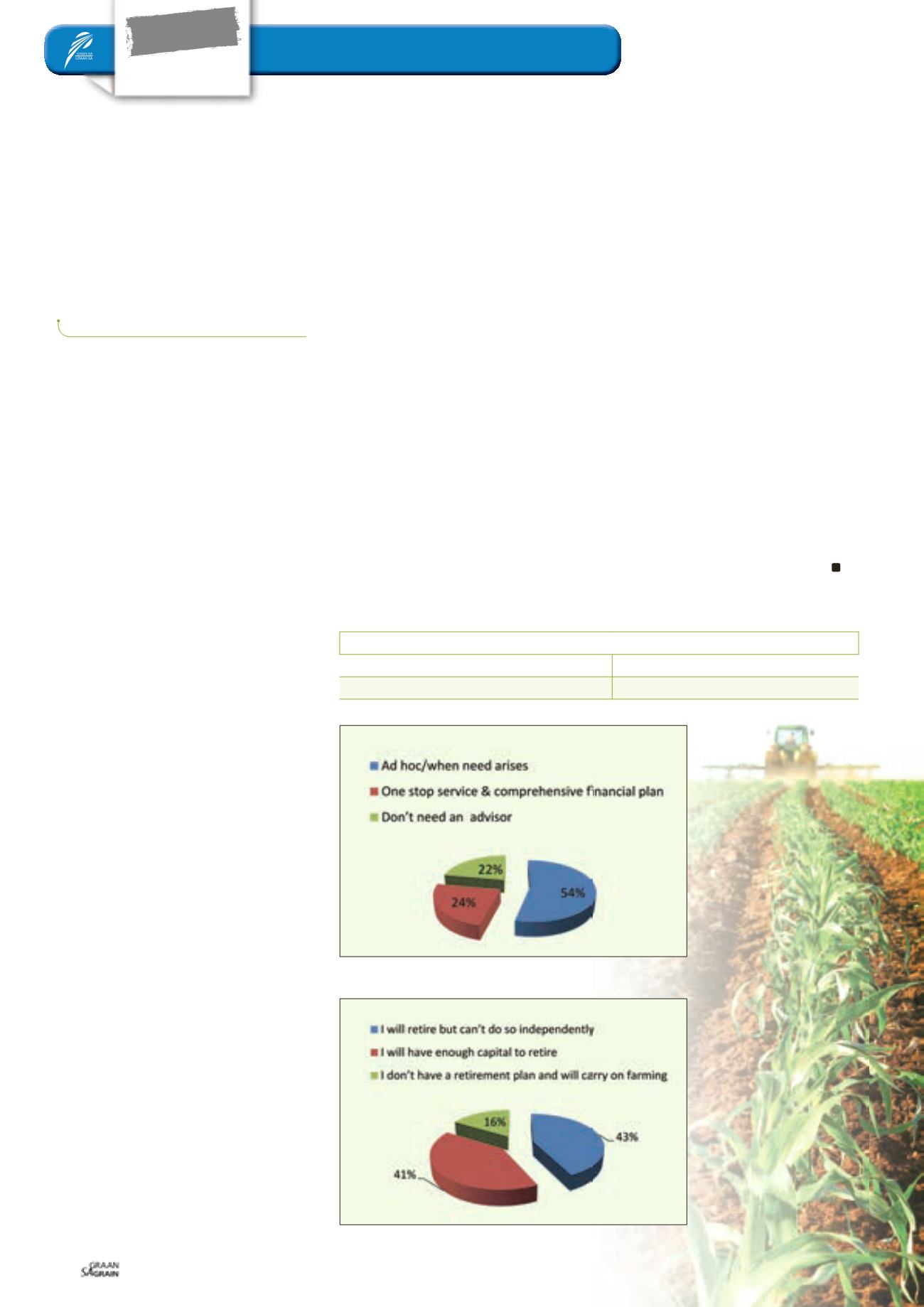

The research shows that 54% of grain pro-

ducers use financial advisers as and when

they need them and only 24% of grain

producers have a comprehensive financial

plan. See

Graph 1

.

If you fail toplan, youplan to fail.A lifeevent

can destroy in a day what may have taken

you and your family years or even decades

to build up. It takes an act of financial stew-

ardship to leave a legacy behind for future

generations.

Sound succession planning requires com-

prehensive financial planning, including

estate and retirement planning. This will

ensure a smooth transition to the next gen-

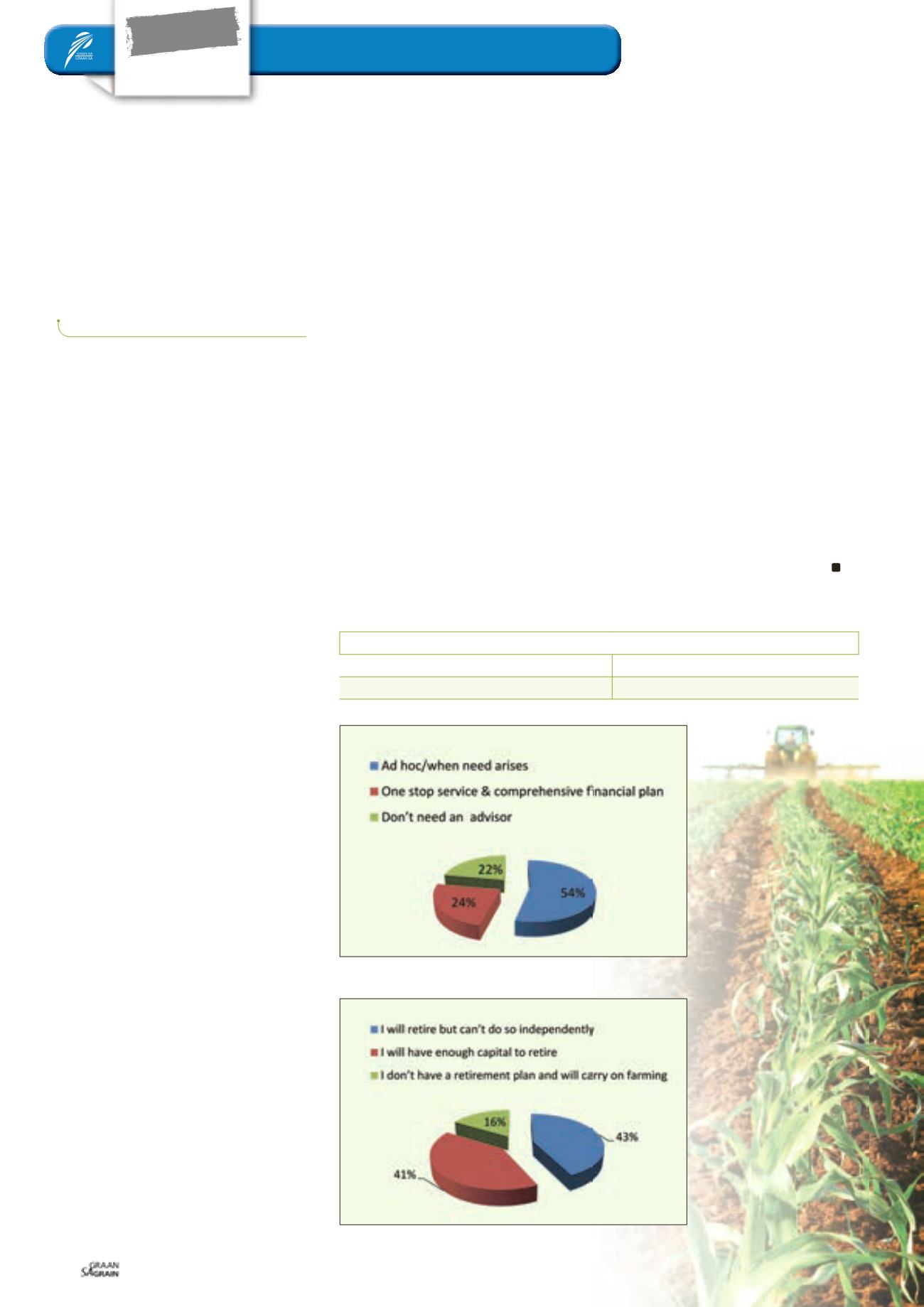

eration. The status of grain producers’ re-

tirement plans is aworrying factor because

only41% indicate that theywill haveenough

capital to retire independently from their

business income. See

Graph 2

.

This means that the incoming generation

will have tosupport theoutgoinggeneration

KOOSNEL,

head: Agri Market, OldMutual

financially,whichplaces stresson the finan-

cial resources of the grain farm. An appro-

priate financial plan should be put in place

tocreatecertainty forboth theproducer and

the successor and their dependants.

Grain producers’ financial planning in the

event of death before retirement seems to

be better addressed than retirement plan-

ning, with 88% having a comprehensive

plan inplace. See

Table1

. However, if this is

compared to other commercial producers,

then it is 5% lower than, for example, the

93%of wool/mohair producers.

As a grain producer you understand how

important it is to plant good seeds in fertile

ground to ensure you reap a good harvest.

To enjoy financial freedom you also have to

sowgood seeds (savings andprotection) to

reap a good financial harvest (accumulated

wealth).

At Old Mutual we make it our business to

prepare financial advisers tohelpyoucreate

ahealthy relationshipwithyour hard-earned

money and to invest your money in aman-

ner that will protect you, your family and

your business against any event in life.

PLAN INTHEEVENTOFDEATH

SUMMERCROPS

I have a comprehensiveplan inplace

88%

This plan is reviewed regularly

81%

Graph 1: Kindof advice/service required from advisor.

TABLE 1: GRAIN PRODUCERS’ FINANCIAL PLANNING IN THE EVENT OF DEATH BEFORE

RETIREMENT.

Graph 2: Status of retirement planning.

FOCUS

Moneymatters and insurance

Special

Product information